Unlock endless learning opportunities

FRANK EDUCATION LOAN FOR LOCAL AND OVERSEAS STUDIES

4.5% per year (EIR: 5.17% per year2 with 2.5% processing fee)

Loan up to 10 x your monthly income or S$150,000 (whichever lower)

Up to 8 years tenure with 3 flexible repayment options to choose from

2Effective Interest Rate (EIR) is assumed on a 2-year course with repayment period of 8 years and Standard Repayment Method. The EIR comprises of 4.5% per year interest rate which is calculated on a monthly rest basis and 2.5% of processing fee of the approved loan amount that is applicable upon disbursement of loan.

GET STARTED IN THREE STEPS

Step 1: Select your school

We can support your studies at local institutes or overseas institutes.

Step 3: Apply

Submit your application with your joint borrower at any OCBC Branch

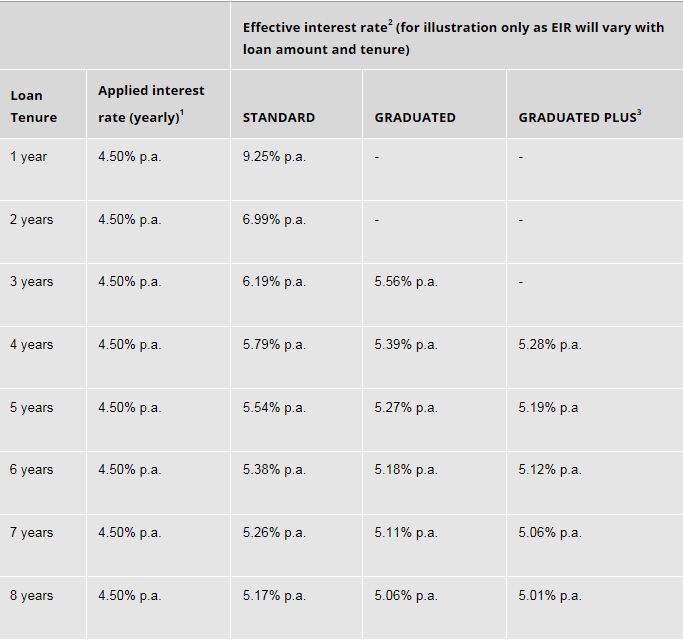

You may refer to the repayment options below.

3 repayment options to suit your needs

REPAYMENT IS BASED ON THE FOLLOWING ASSUMPTIONS:

- Based on a S$10,000 course

- 8-year repayment period

- 24-month course period

- Applied Interest Rate: 4.5% p.a.

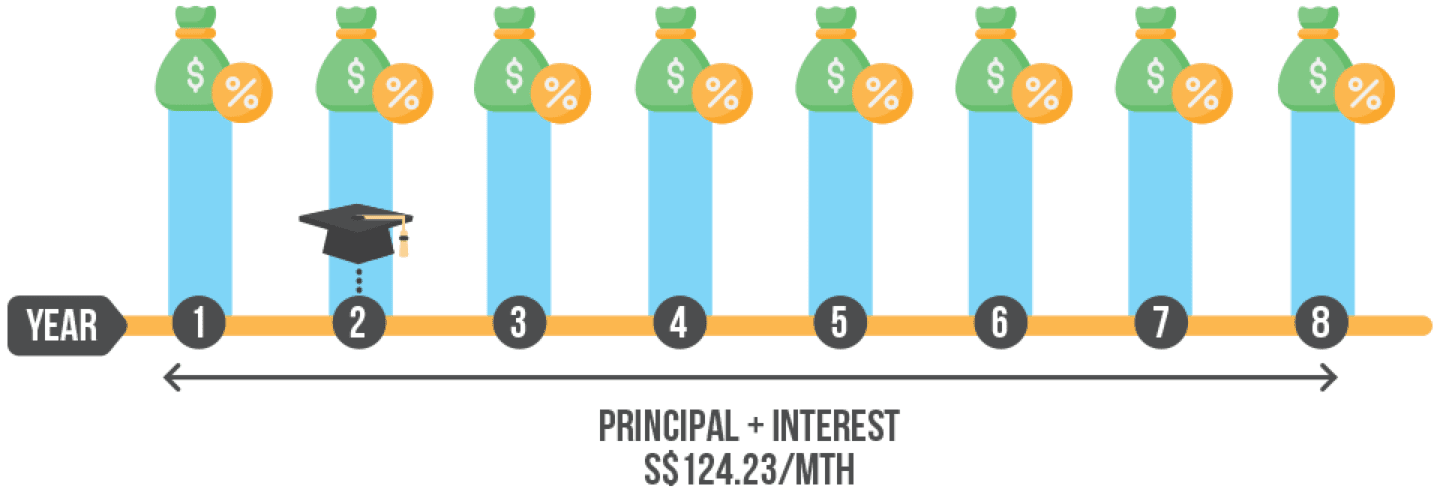

Standard

- Pay your monthly instalments (principal + interest) once your loan is disbursed.

- Effective Interest Rate: 5.17% per year

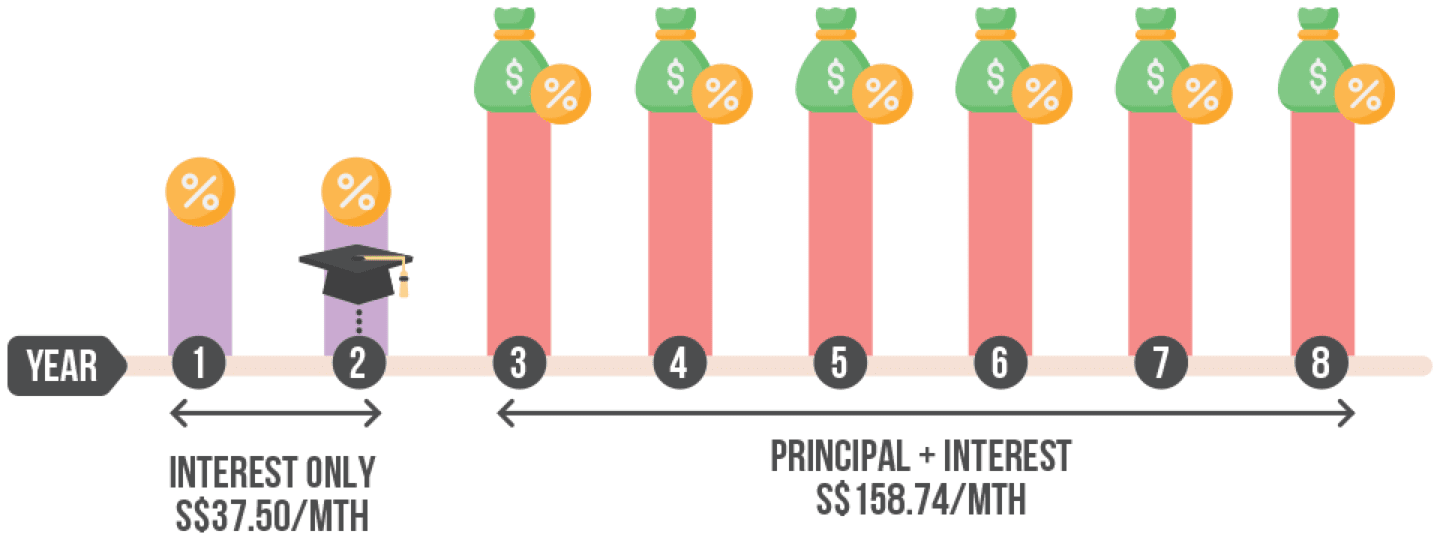

Graduated

- Pay only Interest while studying

- Start paying principal + interest after graduation

- Effective Interest Rate: 5.06% per year

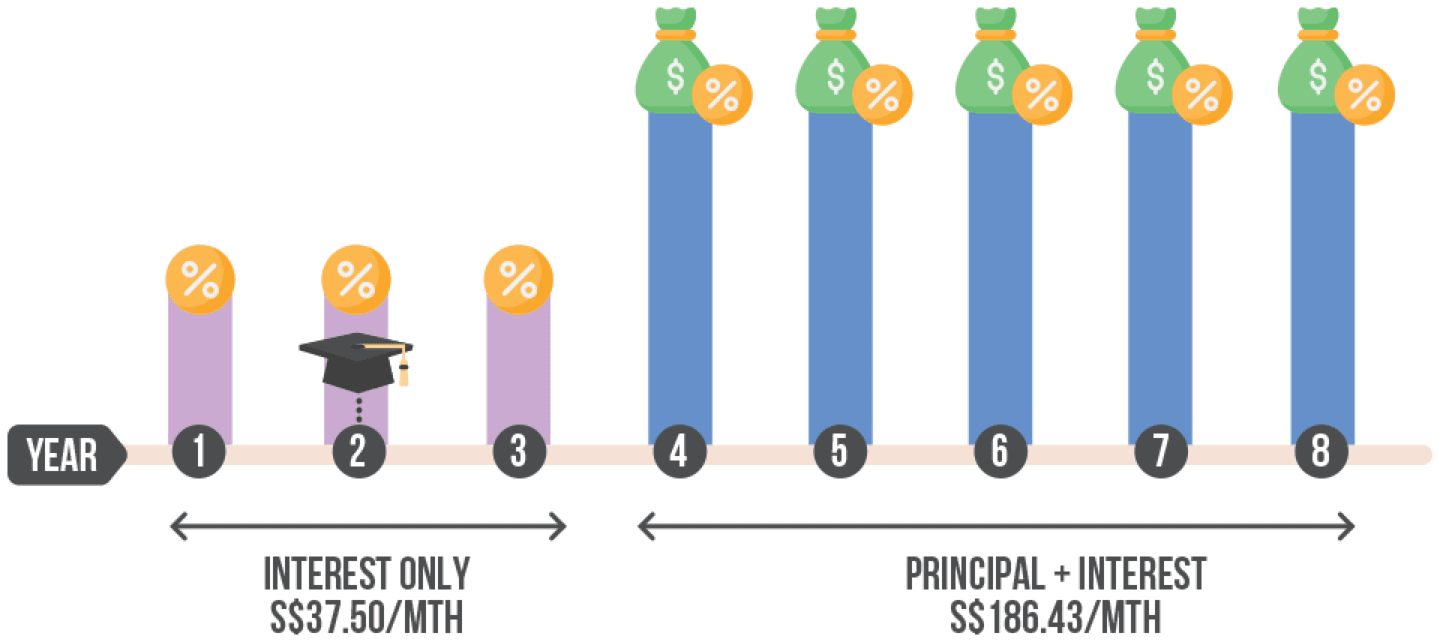

Graduated plus

- Pay only Interest while studying + 1 year after graduation.

- Pay principal + interest from third year onwards.

- Effective Interest Rate: 5.01% per year.

NOTE: For Graduated and Graduated Plus, the loan tenure includes the period of study.

Effective Interest Rates are calculated based on a monthly rest method and include a processing fee of 2.5%of the approved loan amount.

Effective Interest Rate will vary with loan amount and tenure.

A 24-month course period is assumed in the calculation of the Effective Interest Rates for the Graduated and Graduated Plus repayment schemes.

HOW IT WORKS

Apply and Wait for Approval

Visit us, mail us or leave your details. Upon successful application, you will receive an approval letter from us in about 7 working days.

Get your loan disbursed to pay your school fees

Sign the disbursement authorisation form and send it to us at least 7 working days before your school fee payment is due.

Monitor your repayment

Monitor how your loan is being repaid through your statement or Internet Banking.

WHEN YOU GET YOUR LOAN

Step 1

Manage your school fees

Manage your school fees

Submit your loan disbursement form to pay for your school fees at any OCBC Branch

Step 2

Pay your loan

Pay your loan

Start paying for your loan instalments.

Track your loan payments through your statement or Internet Banking.

LEARN MORE ABOUT THE NEW MOE INTEREST RATEs

Starting from 1 April 2024, all new applications for MOE-funded loans will be subject to the revised interest rates. The rate adjustments will occur on a half-yearly basis, effective every 1 April and 1 October.

Refer to our latest page to understand how the new interest rates may impact your loans.

MORE ABOUT OUR LOAN

Eligibility

For main applicant

Aged 17 years old and above

Singaporean / Singapore PR

For joint applicant

Aged 21 years and above

- Maximum 65 years upon loan maturity

- Required for main applicant below 21 years old

- Required for overseas education

Combined annual income

At least S$24,000 per annum

Main (no income)

Joint (at least S$24,000 per annum)

OR

Main (at least S$12,000 per annum)

Joint (at least S$12,000 per annum)

Documents

Applicant

- Recent original telephone bill or original bank statement (if mailing address differs from NRIC).

- A copy of acceptance letter from institution stating type and course duration.

- A copy of schedule of payment for course if not stated in acceptance letter.

Income documents:

For Salaried Employees

If salary is not credited to an OCBC account, submit any of the 2 combinations below:

- Latest CPF statement with full contribution history (at least 3 months)

AND Latest Income Tax Notice of Assessment - Latest computerised/soft copy payslip

AND Latest bank statement showing employer’s name for salary crediting

----OR----

Latest CPF statement with full contribution history (at least 3 months)

----OR----

Latest Income Tax Notice of Assessment

For Self-Employed, commissioned or variable income earners customer

- Last 12 months’ CPF contribution history statement

----OR----

Latest Income Tax Notice of Assessment

Sign Up Rewards

Education Loan + FRANK Visa Debit Card Benefits

Enjoy perks while you push ahead in your studies. Choose from over 60 designs. Annual FRANK Debit Card fee waiver for life. Withdraw cash locally and overseas.

How to get your loan

I need more details

Interested but need to find out more? Submit your interest below and our friendly staff will contact you shortly.

Application forms

Submit your application with your joint borrower at any OCBC Branch

What do I need to prepare:

Applicant:

- NRIC

- Recent original telephone bill or original bank statement (if mailing address differs from NRIC)

- Certified true copy of acceptance letter from institution stating type and course duration

- Certified true copy of schedule of payment for course if not stated in acceptance letter

Income documents:

Salaried Employees

If salary is not credited to an OCBC account, submit any of the 2 combinations below:

- Latest CPF statement with full contribution history (at least 3 months)ANDLatest Income Tax Notice of Assessment

- Latest computerised/soft copy payslip ANDLatest bank statement showing employer’s name for salary creditingORLatest CPF statement with full contribution history (at least 3 months)ORLatest Income Tax Notice of Assessment

Self-Employed, commissioned or variable income earners customer

- Last 12 months’ CPF contribution history statement ORLatest Income Tax Notice of Assessment

Additional Details:

List of overseas institutions for FRANK Education Loan

List of local private institutions for FRANK Education Loan

Terms and Conditions governing Education Loans

Join other trail-blazing young adults in getting monthly career & financial tips, written by those who have succeeded before.

1Effective Interest Rate (EIR) is assumed on a 2-year course with repayment period of 8 years and Standard Repayment Method. The EIR comprises of 4.5% per year interest rate which is calculated on a monthly rest basis and 2.5% of processing fee of the approved loan amount that is applicable upon disbursement of loan.