Executives

Students

IMPORTANT UPDATE

UPCOMING CHANGES TO THE OCBC FRANK ACCOUNT AND OCBC FRANK DEBIT CARD

Exciting changes are coming on 1 October 2025. T&Cs apply.

IMPORTANT UPDATE

UPCOMING CHANGES TO THE OCBC FRANK ACCOUNT

AND OCBC FRANK DEBIT CARD

From 1 October 2025, when you charge at least S$100 to your OCBC FRANK Debit Card (linked to your OCBC FRANK Account) each month, you will earn either extra interest of 1.00% a year OR extra cashback of 1.00%, whichever is higher.

This is on top of the base interest of 0.60% a year on your account balance and base cashback of 0.30% on your debit card spending.

AVERAGE DAILY BALANCE IN YOUR ACCOUNT

0.60%

a year

base interest

on the first S$10,000 in your account

DEBIT CARD SPENDING

0.30%

base cashbackon transactions made using your debit card

UNLOCK EITHER EXTRA INTEREST OR EXTRA CASHBACK

In other words:

- If you qualify for extra interest: You will earn interest of 1.60% a year on the first S$10,000 in the account*, plus cashback of 0.30% on transactions made using the debit card^.

- If you qualify for extra cashback: You will earn cashback of 1.30% on transactions made using the debit card^, plus interest of 0.60% a year on the first S$10,000 in the account*.

* The remaining account balance will earn an interest of 0.05% a year.

^ To find out which transactions qualify, refer to the terms and conditions governing the OCBC FRANK Debit Card.

Terms and conditions governing the OCBC FRANK Account, OCBC FRANK Debit Card, and OCBC FRANK Bonus Rewards Programme apply.

Maximise the rewards you earn

Earn extra interest or cashback when you link your OCBC FRANK Account to your OCBC FRANK Debit Card.

Missing one or the other?

Apply now so you can enjoy the new benefits from 1 October 2025. Terms and conditions apply.

I ONLY HAVE AN OCBC FRANK ACCOUNT

I ONLY HAVE AN OCBC FRANK ACCOUNT

Get an OCBC FRANK Debit Card.

Get an OCBC FRANK Debit Card.

I ONLY HAVE AN OCBC FRANK DEBIT CARD

I ONLY HAVE AN OCBC FRANK DEBIT CARD

Open an OCBC FRANK Account (it will come with another OCBC FRANK Debit Card*).

Open an OCBC FRANK Account (it will come with another OCBC FRANK Debit Card*).

For more details, refer to our FAQ.

* Your existing OCBC FRANK Debit Card will not be affected. You may keep it and link to it to the OCBC FRANK Account, or, cancel it and use the new OCBC FRANK Debit Card.

Insured up to S$100k by SDIC.

For executives

Make your money work harder

Get up to 1.55% a year for just crediting your salary in an OCBC 360 Account. What's more, earn 6% cashback when you spend with FRANK Credit Card.

For students

Study, play, earn

Gain 4x more interest when you save with a FRANK Account. Plus, choose from 60 designs and get the best deals with FRANK Debit Card.

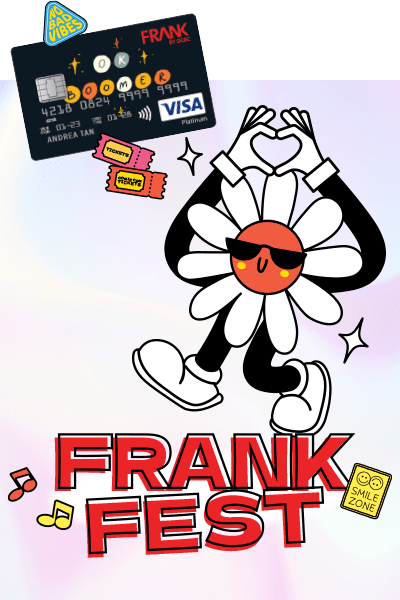

LATEST EVENT

FRANK FEST 2023: RING IN THE YEAR-END VIBES

As the year comes to an end, get ready for our first ever FRANK festival – we're bringing the craziest lineup of deals, promos and giveaways just for you. Win Taylor Swift goodies, enjoy free entry to Marquee Singapore and stay tuned for more awesome surprises coming your way!

Blog

Knowledge = money

Read up for the best ways to start your financial journey and grow.

-

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.