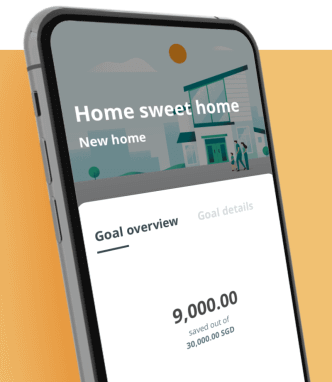

Check off your wishlist

You deserve all the nice things so why not get your hands on them with Savings Goals – it automatically saves money for you each month, all within one bank account!

- Cultivate a disciplined saving habit

- No need to open a second account just for savings

- Take your money out anytime

Other Features

More to digital banking

Money in$ights & Budgeting

Take control of your spending

Discover your spending habits and set budgets each month – all with the Money In$ights and Budgeting tool built into your accounts.

Discover your spending habits and set budgets each month – all with the Money In$ights and Budgeting tool built into your accounts.

Grow your wealth

Invest on your own terms

Build your portfolio, get alerts on market changes and gain access to investing insights through the OCBC Mobile Banking app.

Build your portfolio, get alerts on market changes and gain access to investing insights through the OCBC Mobile Banking app.

FAQ

See all FAQ-

How do I access Savings Goal?

Savings Goal can be accessed through online or mobile banking.

Online banking users can search for Savings Goal on dashboard once login, located on the right panel.

Mobile banking users can access Savings Goal by tapping on top left menu > Track and Manage > Savings Goal; top left menu > Track and Manage > MoneyIn$ights > scroll down the page to Savings Goal; dashboard once login to mobile banking; -

Will I be able to access or withdraw the money that is deposited into the designated savings goal account?

No, you will not be able to withdraw or access the money that is contributed into the savings goals, however, you will be able to unlock and release the money set aside in savings goals to regain access to the money or for ATM withdrawal.

-

When money is deducted to my savings goal, will it show the deduction in my current/savings account?

Yes, you can refer to available balance amount after the deduction has been made from your current/savings account to deposit into your savings goal.

-

How long can I pause my recurring contribution towards savings goal?

You may pause the recurring deposit for as long as you want.

-

Will I still be entitled to the interest rate for my current/savings account If I were to create 1 or multiple Savings Goal?

Yes, the interest rate will remain the same to your account type