Take control of your spending

With Money In$ights and Budgeting, you can track exactly where your money is going and set monthly budgets to keep your spending in check.

- Discover your top spending categories

- Set budgets by category or monthly limits

- Get notified when you’re about to exceed your budget

Money In$ights

Discover your spending habits

Sometimes catch yourself wondering where your money went? We totally get it. With Money In$ights, we’ll show you exactly what you’ve spent on and all changes in your balances.

Budgeting

Plan your monthly expenses

You’ve learnt about your spending habits. What’s next? Planning your next steps of course!

Other Features

More to digital banking

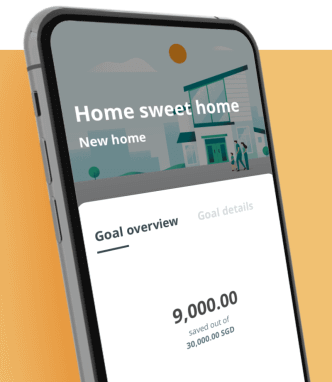

Savings Goals

Check off your wishlist

Automatically set aside monthly savings and track your progress with Savings Goals.

Automatically set aside monthly savings and track your progress with Savings Goals.

Grow your wealth

Invest on your own terms

Build your portfolio, get alerts on market changes and gain access to investing insights through the OCBC Mobile Banking app.

Build your portfolio, get alerts on market changes and gain access to investing insights through the OCBC Mobile Banking app.

FAQ

See all FAQ-

How do I access Money In$ights?

-

Money In$ights can be accessed through online or mobile banking.

-

Online banking users can search for Money In$ights under the “Your Accounts” tab after logging in.

-

Mobile banking users can access Money In$ights by tapping on top left menu > Track and Manage > Money In$ights.

-

-

What are the charts that I see on the Money In$ights page?

The Money Flow chart allows you to see where your money in your accounts flows over time. You'll see a detailed categorization of your spending when you scroll down. This makes your online banking experience with us easier and more intuitive. At a glance, you'll be able to see if there is an increase in your spending or if you're on track with your savings plan.

-

Which accounts are included in Money In$ights?

Money In$ights includes transactions and balances for all your current, savings, credit cards and EasiCredit accounts.

-

Can I add more categories by myself?

We have 20 different categories, including the newly added Cash Withdrawals category, available for you to tag your spending to and we believe that should cover most types of spending that you normally incur.

-

What happens if I spend more than my budget? Is there a penalty?

No worries! This is just a tool to help you monitor your money so there is no penalty. The excess amount spent will be reflected in red in the Money Flow chart or Category chart.