Graduating Class 2021

Just graduated and moving on to the next phase of your life?

Just graduated and moving on to the next phase of your life?

GRADUATING CLASS 2021

Entering the workforce, taking in your first income – your next phase of life is going to be exciting! No matter what path you choose, whether it's freelancing or a full time job, we're more than happy to celebrate with you.

OCBC 360 account

Scoring the best interest with 360 Account when you credit your salary after you graduate

-

Maximise your interest earned

Maximise your interest earnedJust graduated and starting your first job? Take advantage of the OCBC 360 Account's high interest rates of up to 1.2%! Simply GIRO your monthly salary of at least S$1,800 to get started.

Get S$25 on us when you register your interest, open a 360 Account and credit your salary of at least S$1,800 today!

T&Cs apply.

Growing my savings just got easier

How to unlock more interest on your 360 Account

First S$35,000

Next S$25,000

Next S$25,000

Credit your salary of at least S$1,800 a month via GIRO

Increase your average daily balance by at least S$500 monthly

Purchase an eligible insurance product from OCBC

Purchase an eligible investment product from OCBC

Base interest

0.4%

a year

Maintain an average daily balance of at least S$200,000

0.05%

a year

Earn this base interest on your entire account balance

link FRANK to pAYNOW

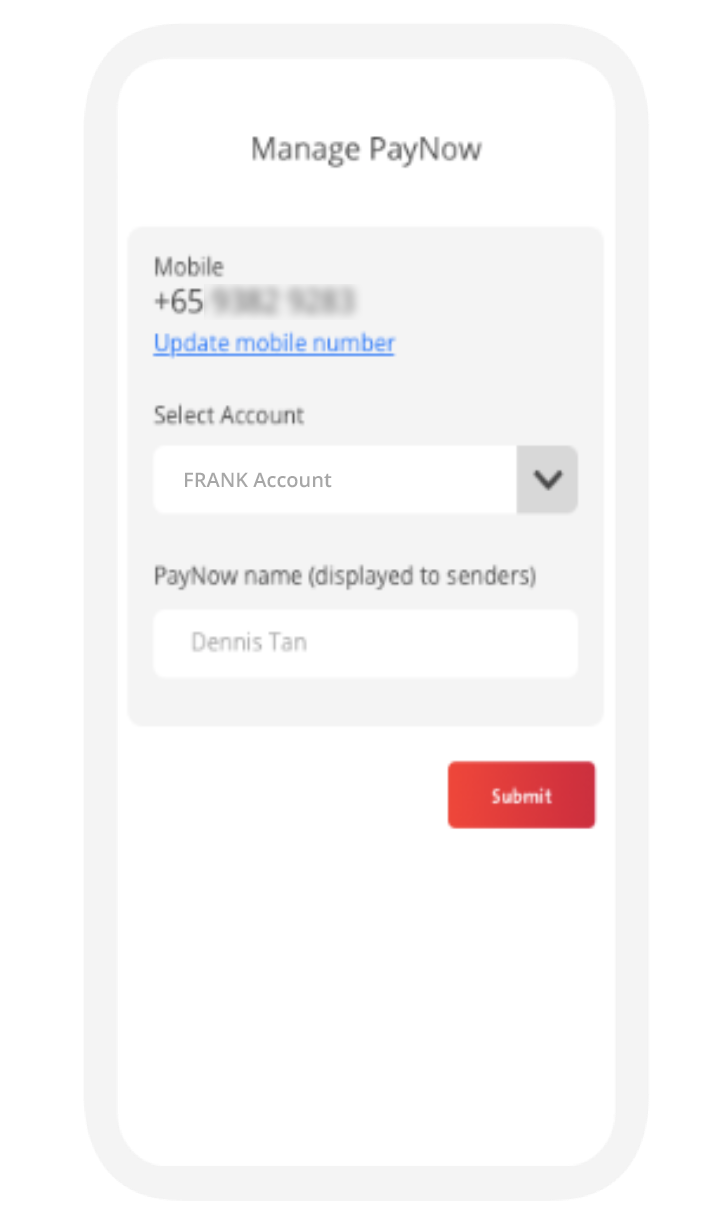

Make FRANK as your primary account, transacting through PayNow is a breeze!

-

Save, earn & accumulate more

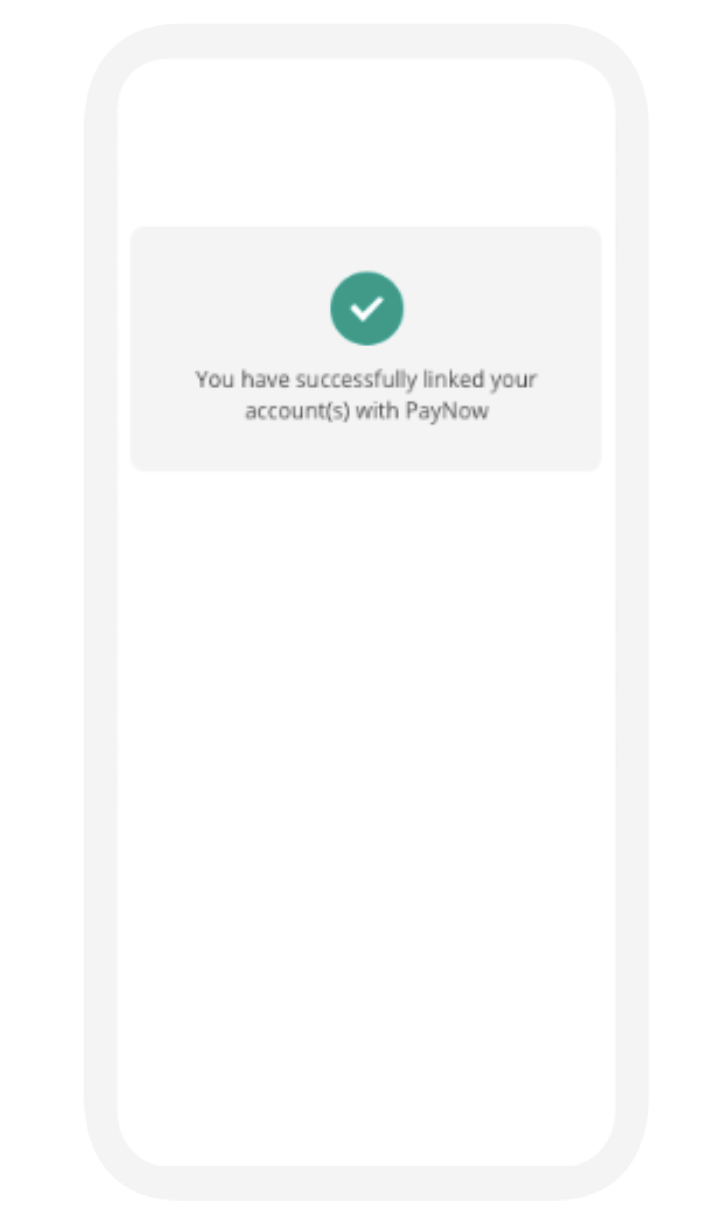

Save, earn & accumulate moreFRANK gives you a 0.2% interest rate, which is 4x the base interest of a regular savings account – making it the best account for multiple streams of income from freelancing or part-time work! You can also link your PayNow to track all your incoming and outgoing payments easily.

Get S$5 on us when you register your interest and link PayNow to your FRANK Account via your Mobile Number from now till September 2021! For the first 500 pax only. T&Cs apply.

One account to do it all

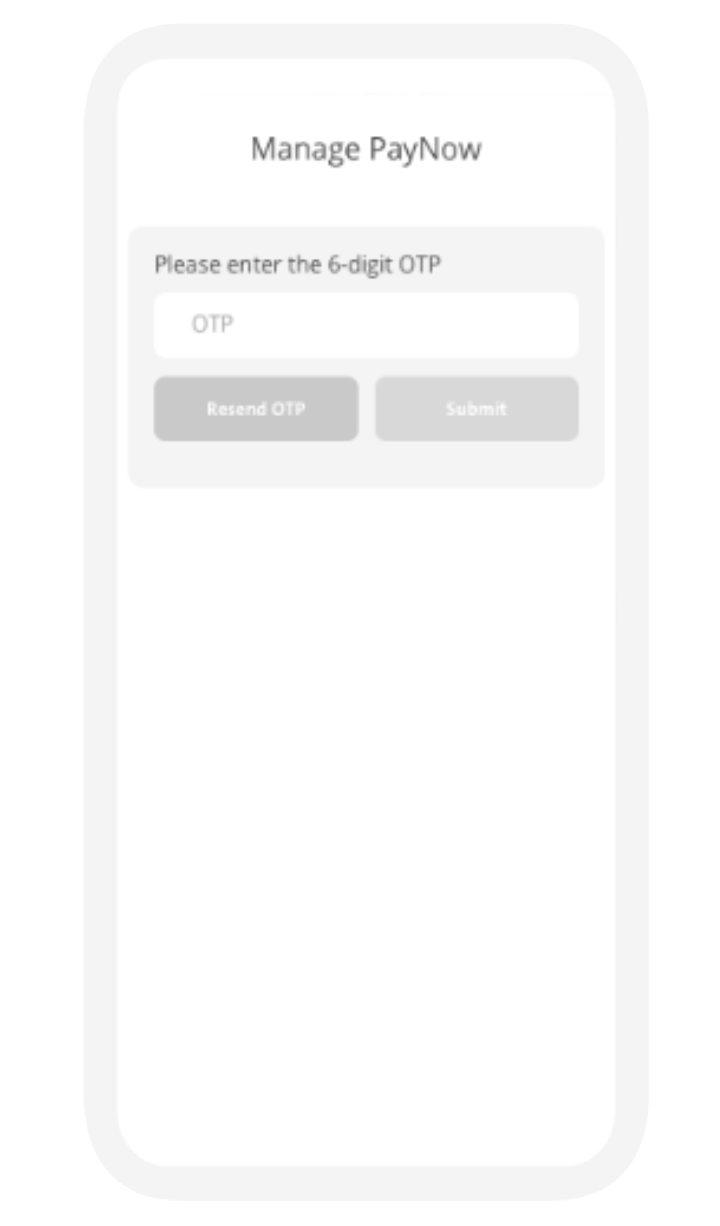

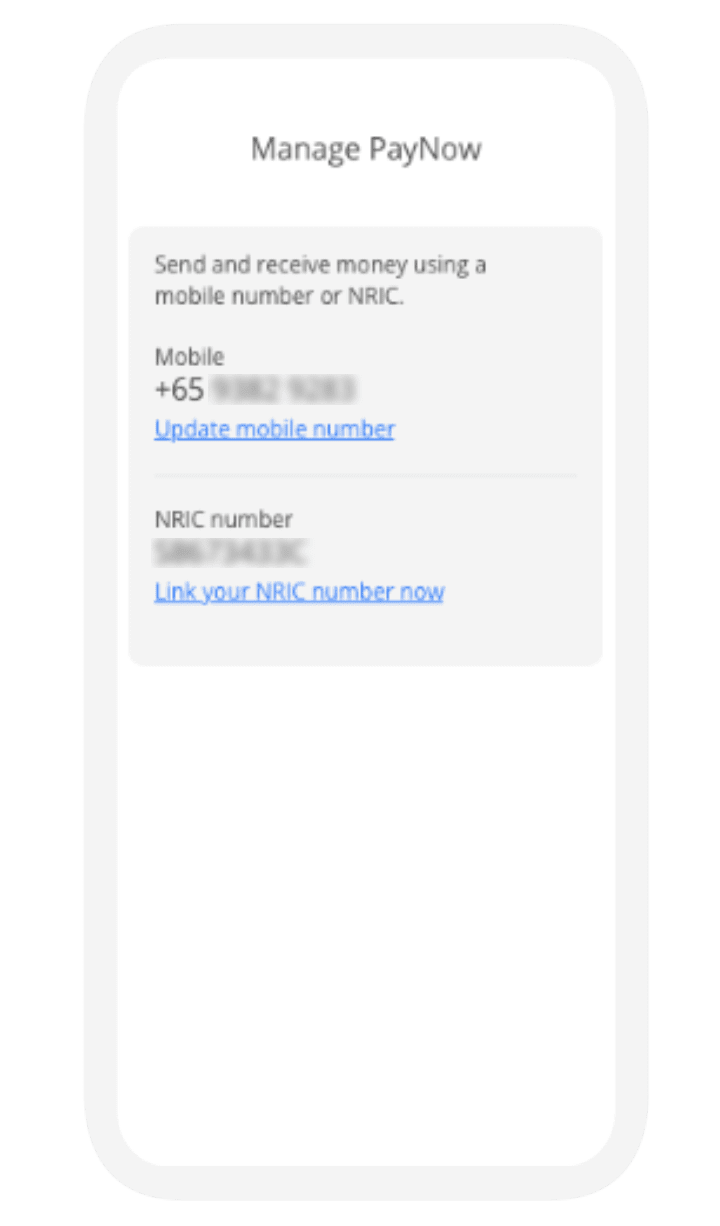

How to link PayNow to Frank Account

-

Terms and conditions