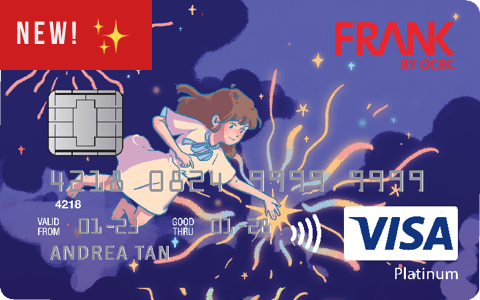

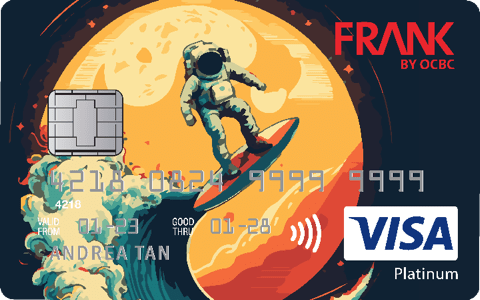

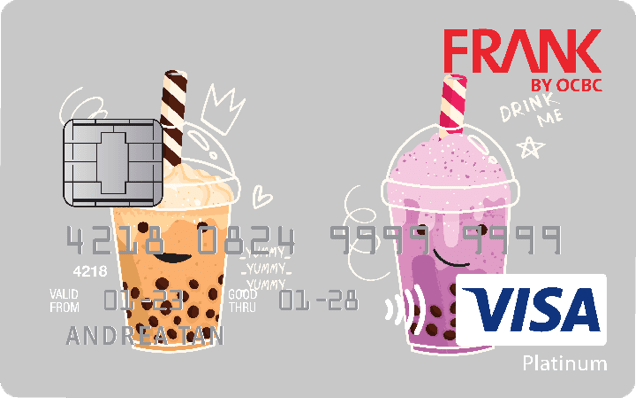

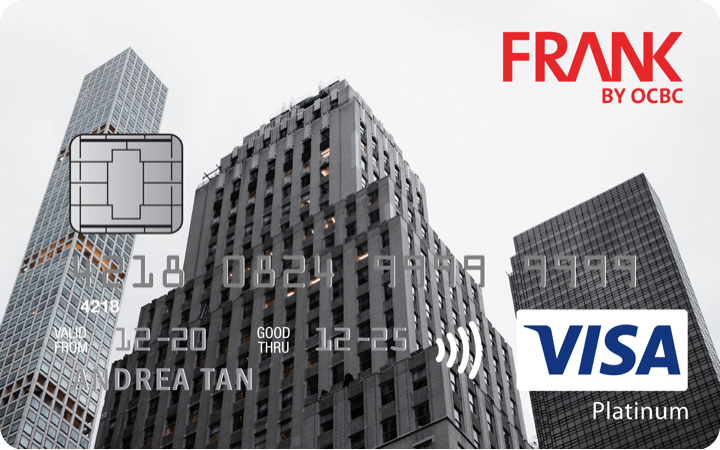

COOL DROPS TO MATCH

YOUR VIBES

Earn S$18 cash credit when you deposit S$188 in fresh funds!

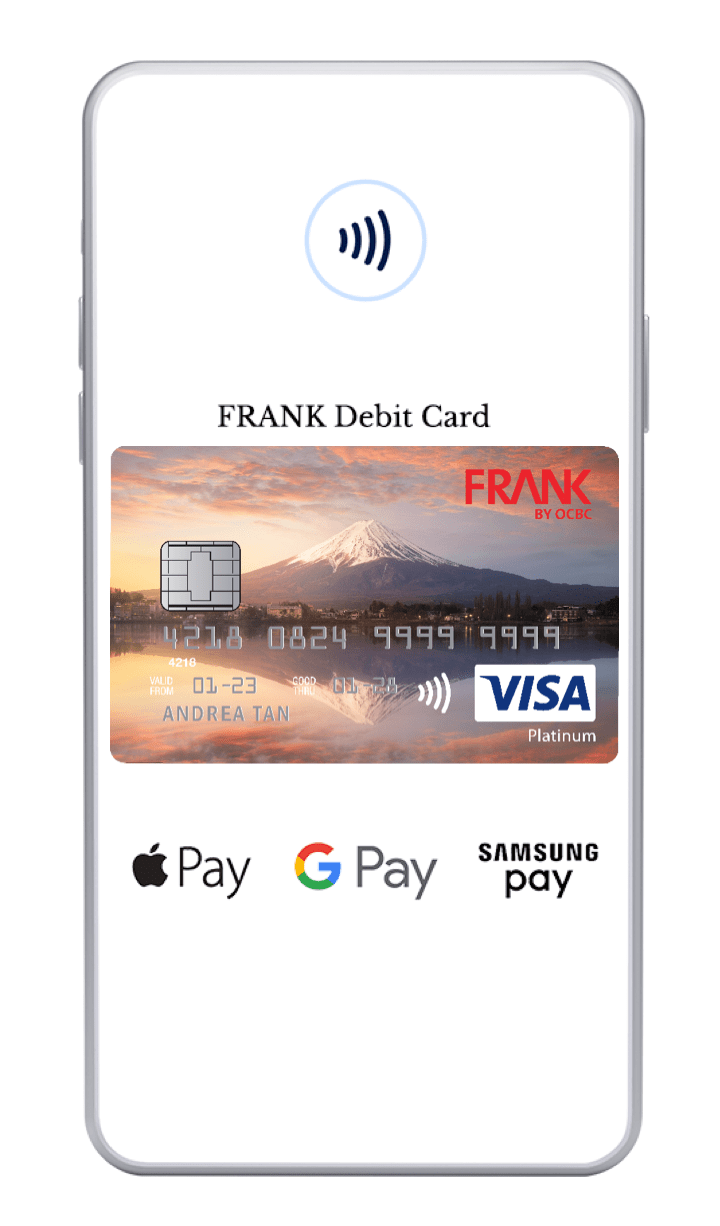

USE YOUR DIGITAL CARD INSTANTLY

Don't have time to waste? Access your debit card and account right away when you apply online.

MEET YOUR NEW ALL-IN-ONE SIDEKICK

The all-in-one debit card that's always got your back – and earns you real perks along the way.

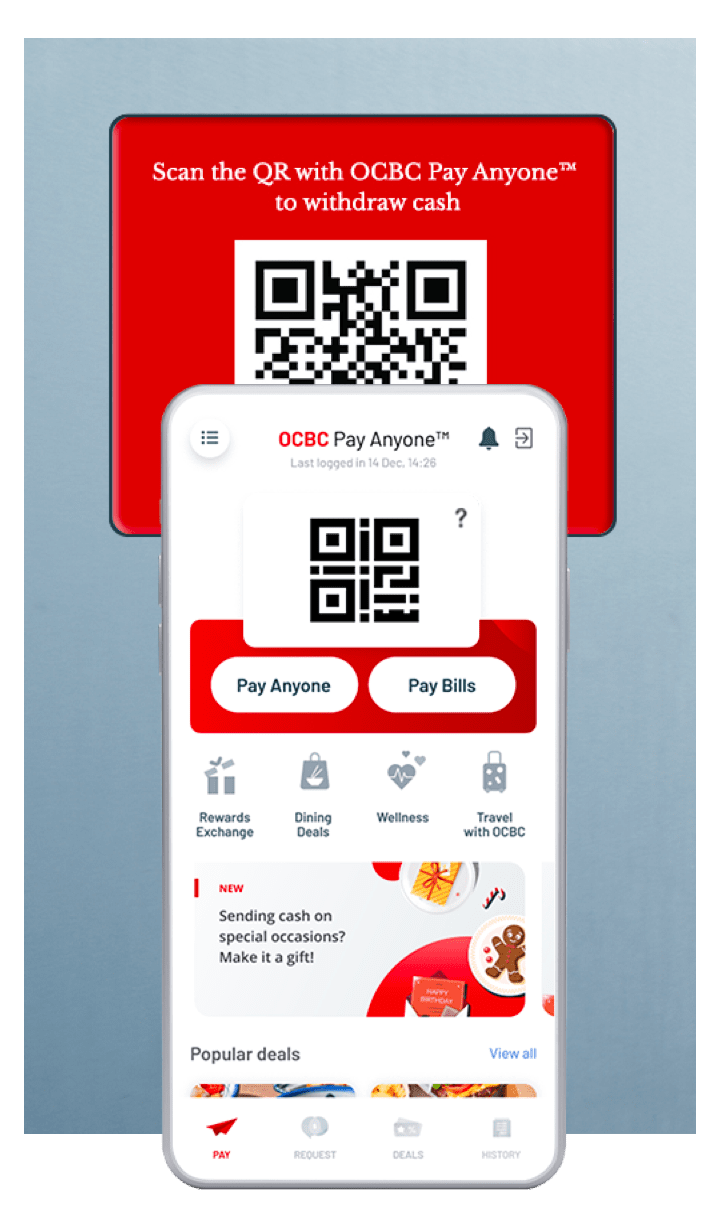

GET YOUR CASH FIX IN A FLASH

No card, no problem. Simply hit up any OCBC ATM to withdraw cash conveniently using the QR code. It's that easy!

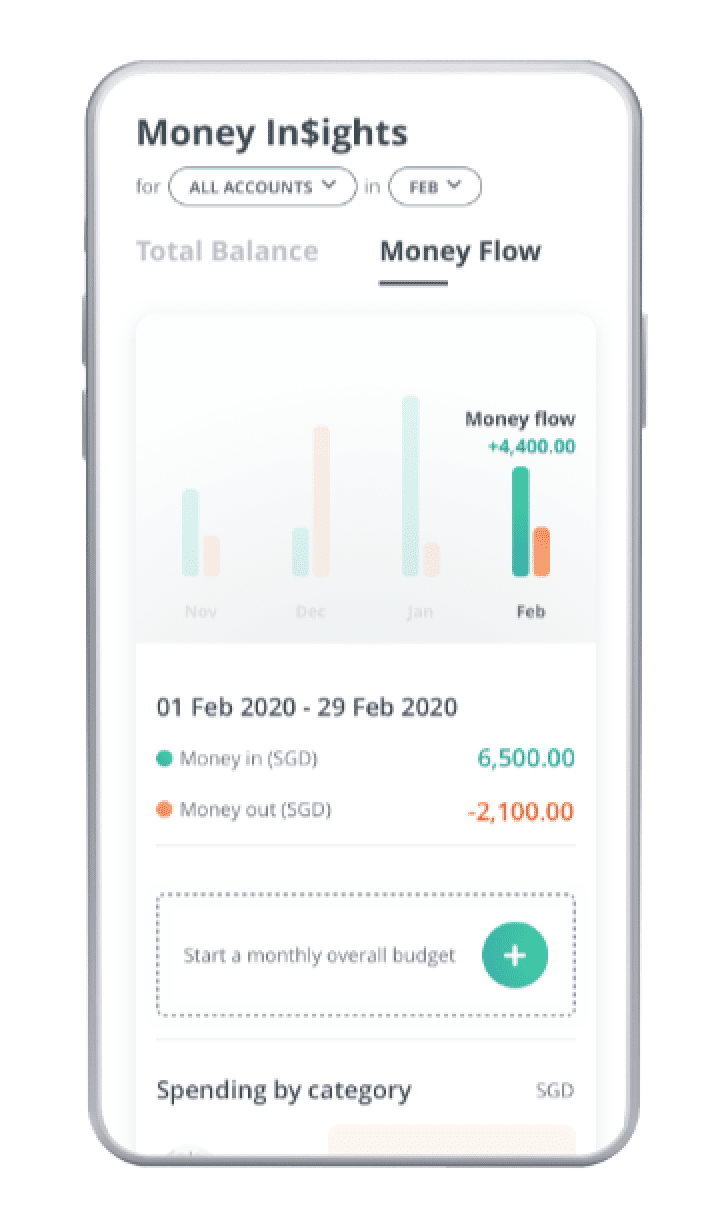

KICKSTART YOUR FINANCIAL INDEPENDENCE

Take control of your everyday finances and keep track of your expenses with a 24/7 accountant at your fingertips.

BONUS QUARTERLY PROMOTION

GET A 1% CASHBACK BOOST ON APPLE AND SAMSUNG DEVICES

This is the best time to see to your back-to-school needs! From now till 31 October 2023, earn 1% cashback when you shop at Apple.com, Apple stores, Samsung.com and Samsung stores.

FRANK DEBIT CARD + ACCOUNT

LEVEL UP YOUR SAVINGS GAME WITH THE FRANK ACCOUNT

-

S$0initial deposit

You don't need a single dollar to get started. Just open the account and you're good to go!

-

S$0fall below fees

Saving up for something big or looking to stretch your budget further? Do it all without any fear of extra charges.

-

4xhigher interest

Grow your savings while you live your best life with up to 0.2% a year in interest.

National Day Card Designs

8 Limited Edition Designs

To commemorate Singapore’s 58th National Day, we have collaborated with the little dröm store to create 8 limited edition FRANK Debit Card designs. These were inspired by iconic elements that embody the spirit of Singapore. Founded by 2 graphic designers, the little dröm store produces quirky merchandise inspired by ‘everyday Singapore’. Learn more about the store, its founders, and get into the inspiration and stories behind their creations.

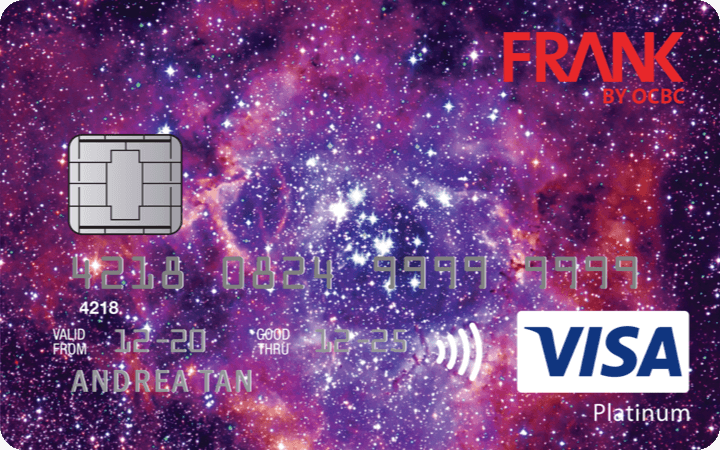

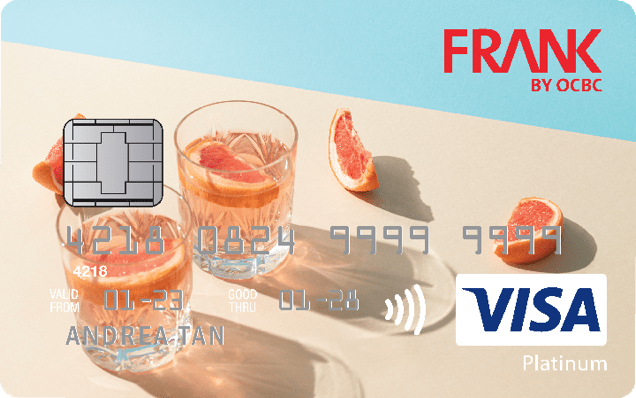

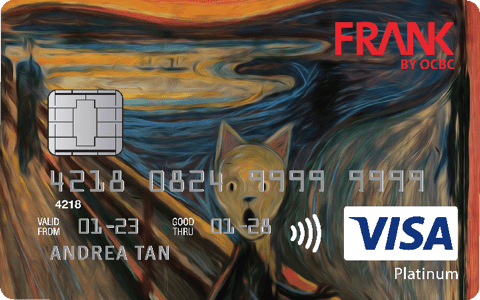

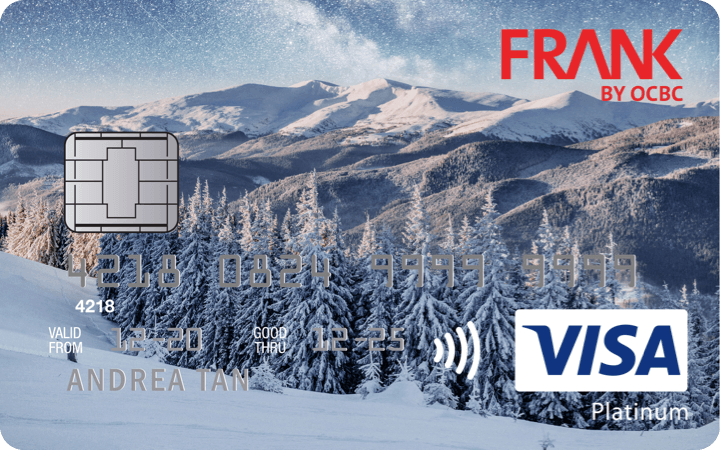

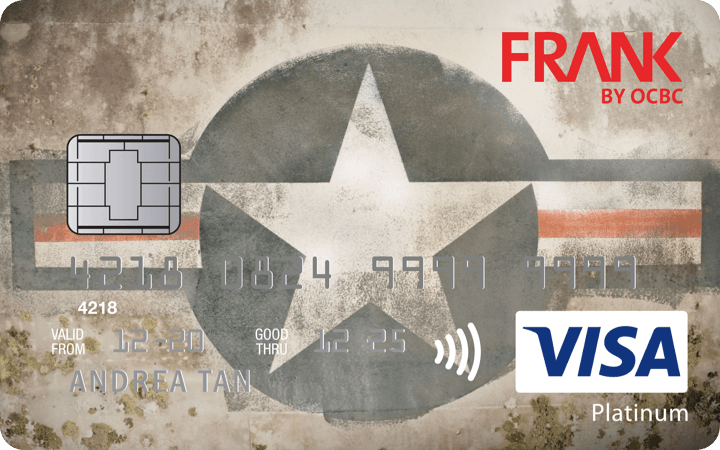

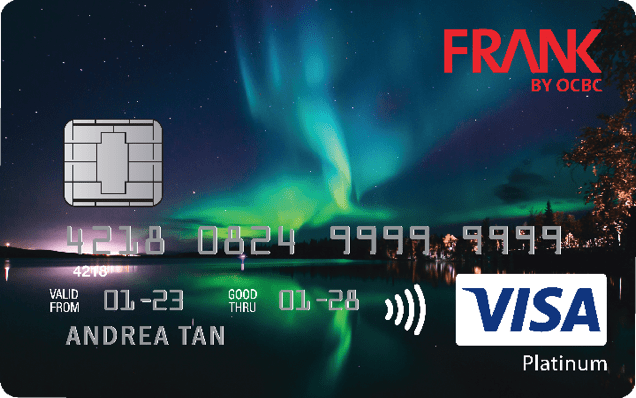

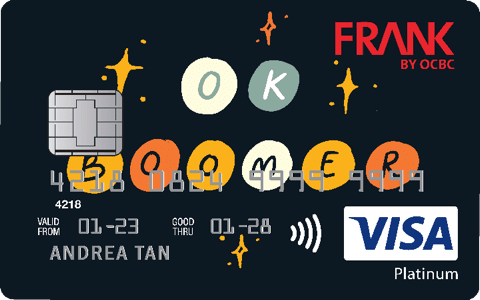

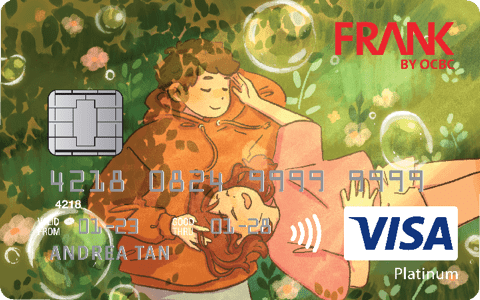

FIND YOUR #FRFR AESTHETIC

MATCH YOUR DRIP WITH MORE THAN 60 CARD DESIGNS

Golden Village Promotion

Get 1 free ticket with every 3 tickets purchased

- Valid for all Day sessions including Public Holidays and eve of Public Holidays.

Limited to the first 500 redemptions per month, from now till 31 May 2026.

T&Cs apply.

Terms and conditions

- Valid till 31 May 2026.

- Promotion is valid for Online, iGV or over-the-counter purchases, unless otherwise stated.

- Payment must be made with an OCBC MyOwn or FRANK Visa Debit Card.

- Valid for the first 500 redemptions per month, while stocks last.

- Valid for all Day sessions including Public Holidays and eve of Public Holidays.

- Not valid for corporate bookings, Gold Class®, Gold Class Express, sneaks, premium-priced films/events, Hindi/Tamil films, special themed event movies, premieres, movie marathons, film festivals, special events, other discounts/promotional offers and otherwise stated.

- GV reserves the right to alter the terms of this promotion without prior notice.

- Merchant’s terms and conditions apply. Please contact the Merchant directly for full details.

- OCBC and the Merchant reserves the right at its absolute discretion to terminate the promotion or vary, delete, or add to the promotion, or any of these terms and conditions, at any time without notice including without limitation, the dates of the promotion.

- OCBC shall not be responsible for the quality, merchantability or fitness for any purpose or any other aspect of any product/service. Notwithstanding anything herein, OCBC shall not at any time be responsible or held liable for any defect or malfunction in any product or the deficiency in any service provided, and/or any loss, injury, damage, or harm suffered or incurred by or in connection with the use of any product/service by any person.

- OCBC’s decision on all matters relating to the promotion will be final and binding on all participants. No correspondence or appeal shall be entertained by OCBC. In the event of any inconsistency between these terms and conditions and any brochure, marketing or promotional material relating to the promotion, these terms and conditions shall prevail.

- These terms and conditions shall be governed by the laws of Singapore and each participant in the promotion irrevocably submits to the non-exclusive jurisdiction of the courts of Singapore. A person who is not a party to any agreement governed by these terms and conditions shall have no right under the Contracts (Rights of Third Parties) Act 2001 to enforce any of these terms and conditions.

SIGN-UP PROMOTION

GOLDEN VILLAGE PROMOTION

Get 1 free ticket with every 3 tickets purchased exclusively with FRANK Debit Card and OCBC MyOwn Debit Card.

Valid for all Day sessions including Public Holidays and eve of Public Holidays.

Limited to the first 500 redemptions per month, from now till 31 May 2026. T&Cs apply.

Latest PROMOTION

All your fave deals, in one spot

We’ve rounded up the hottest offers in one place – enjoy food, fashion and travel deals from over 100 merchants!

Latest drop

EXCLUSIVE THE SIMPLE SUM CARD DESIGNS

Get your hands on the limited edition FRANK Debit Card featuring The Simple Sum characters: Sam the sotong, Ah Long the shark and Ollie the otter.

The Simple Sum is a financial literacy platform that empowers young adults to successfully manage their financial journey.

Follow @frankbyocbc and @The Simple Sum on Instagram to get first dibs on the upcoming FRANK x The Simple Sum Youth Financial Series!

ONGOING SPECIALS

ENJOY THESE LIMITED-TIME OFFERS

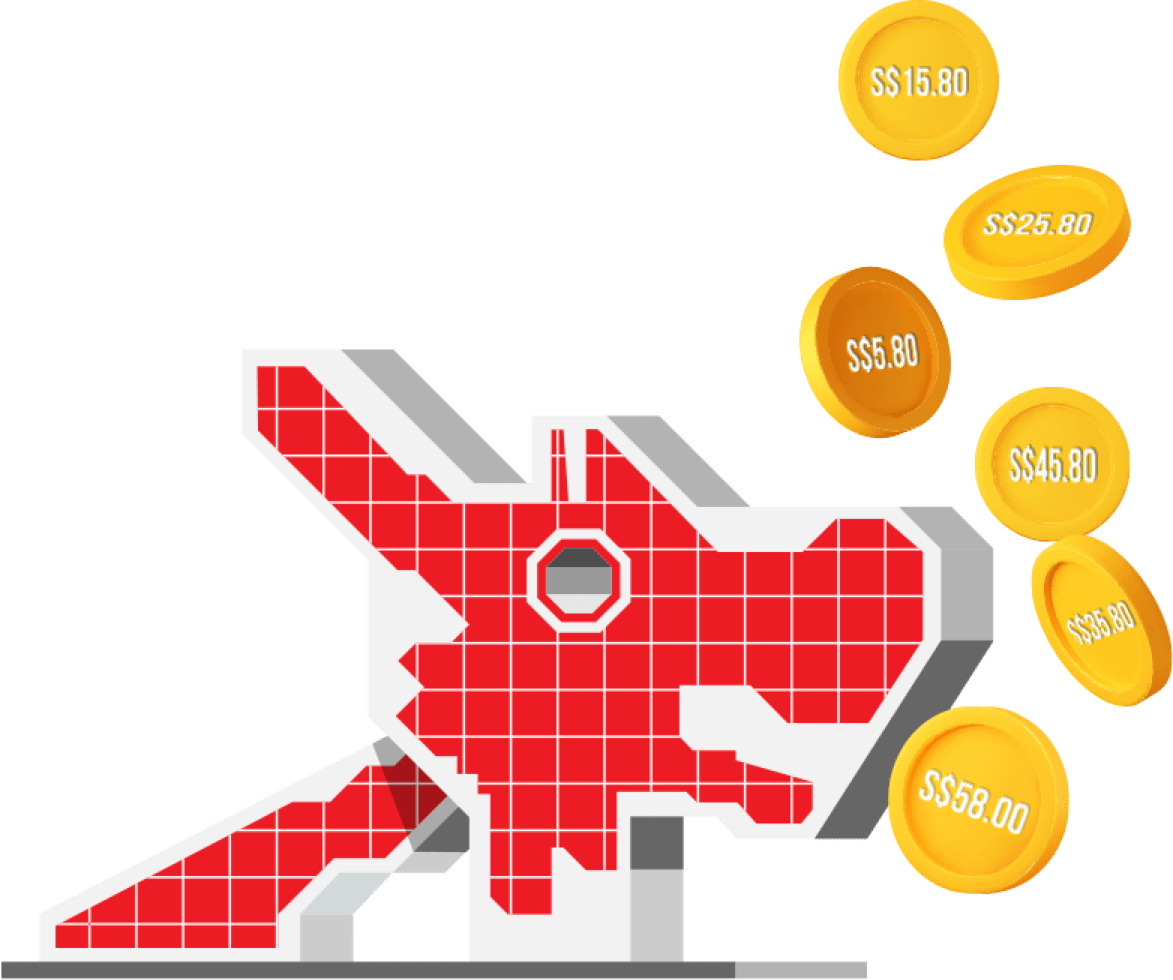

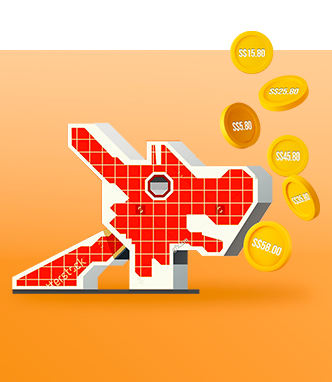

National Day Sign-up Promo

Win up to S$58 in Cashback

Celebrate Singapore’s 58th birthday with FRANK! Apply for a FRANK Debit Card between 1 and 31 August 2023. Charge at least S$58 to your Card by 30 September 2023. You will stand a chance of earning cashback ranging from S$5.80 to S$58.

Celebrate Singapore’s 58th birthday with FRANK! Apply for a FRANK Debit Card between 1 and 31 August 2023. Charge at least S$58 to your Card by 30 September 2023. You will stand a chance of earning cashback ranging from S$5.80 to S$58.

OTHER PROMOTIONS

FRANK X SHOPEE DEBIT CARD DESIGN

Apply for a Shopee design FRANK Debit Card by 31 August 2023 and receive a S$10 Shopee Voucher. Limited to the first 100 eligible applicants.

Apply for a Shopee design FRANK Debit Card by 31 August 2023 and receive a S$10 Shopee Voucher. Limited to the first 100 eligible applicants.

CHINESE NEW YEAR PROMO

GET S$18 WHEN YOU JOIN US NOW

From 1 January to 31 March 2024, receive S$18 cash credit when you apply for both a FRANK Account and FRANK Debit Card, and deposit S$188 in fresh funds. Fresh funds must be maintained until the end of next month.

National Day Sign-up Promo

Win up to S$58 in Cashback

Celebrate Singapore’s 58th birthday with FRANK! Apply for a FRANK Debit Card between 1 and 31 August 2023. Charge at least S$58 to your Card by 30 September 2023. You will stand a chance of earning cashback ranging from S$5.80 to S$58.

USE YOUR DIGITAL CARD INSTANTLY

Don't have time to waste? Access your debit card and account right away when you apply online.

MEET YOUR NEW ALL-IN-ONE SIDEKICK

The all-in-one debit card that's always got your back – and earns you real perks along the way.

GET YOUR CASH FIX IN A FLASH

No card, no problem. Simply hit up any OCBC ATM to withdraw cash conveniently using the QR code. It's that easy!

KICKSTART YOUR FINANCIAL INDEPENDENCE

Take control of your everyday finances and keep track of your expenses with a 24/7 accountant at your fingertips.

Before you apply

-

Eligibility

Min. age

16 years old

-

APPLICATION GUIDE

Singaporeans or Singapore PR with Singpass (Instant Approval)

Foreigners

Apply via form application or visit any FRANK store

READY TO SIGN UP, FOR REAL FOR REAL?

No Singpass account? Let us guide you through the application process from start to finish.

FAQ

See all FAQ-

How long does it take for new/replacement card to reach me?

It takes about 10 working days.

-

How do I change my card design?

If you are an existing FRANK Debit Cardmember and wish to change your design, you can visit an open OCBC branch, or call our hotline +65 6363 3333.

-

My card is expiring soon. What should I do?

A renewal card will be sent to you one month before it expires. Your card will be mailed to your mailing address.

-

Can I change my card design once it expires?

You may submit the following form - Debit Card Maintenance Form indicating the NEW design of your choice. Alternatively, you may head down to any OCBC Branches to request for a change of card design.

-

What are the replacement charges for the FRANK Debit Card?

Card replacement fee is waived for up to 2 replacement in 12 months period and a S$30 card replacement fee applies from 3rd card onwards. From 1 January 2023, the card replacement fees from 3rd card replacement onwards will be updated to S$32.40.

-

Terms and conditions

- Terms and Conditions Governing FRANK Debit Card 1% Cashback (with effect of 1st April 2023)

- Terms and Conditions Governing Card Replacement here

- Terms and Conditions Governing the OCBC We Missed You 2025 H1 Campaign

- Debit Cardmembers Agreement

- Terms and Conditions Governing FRANK Debit Card July S$60 Campaign

- Terms and Conditions Governing FRANK Debit Card July Minimum Spend Campaign

-

Important notices

With effect from 18 June 2016, the Debit Cardmembers' Agreement will be revised to address, among other matters, amendments and provisions relating to the introduction of digital payment services and malware risks. Please view the revised Debit Cardmembers' Agreement

-

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.