FRANK Account & Frank Debit Card

Simple, thoughtful and stylish – deposit account and debit card suited for students! Save when you spend on things you already love.

- *NEW* - Receive and use your digital card instantly when you apply via MyInfo

- Enjoy an interest rate of up to 0.3% per year

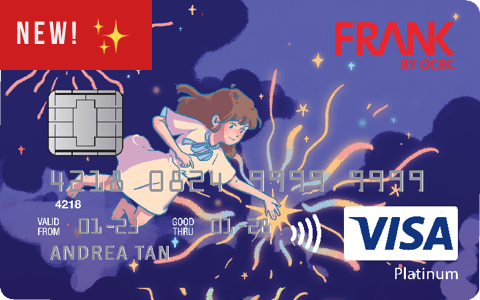

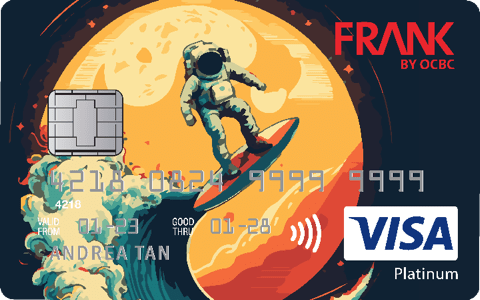

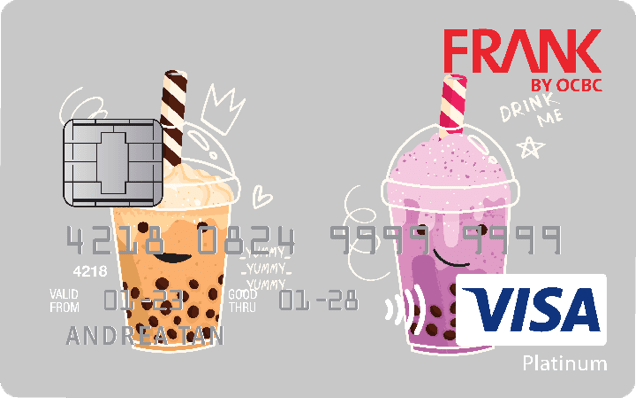

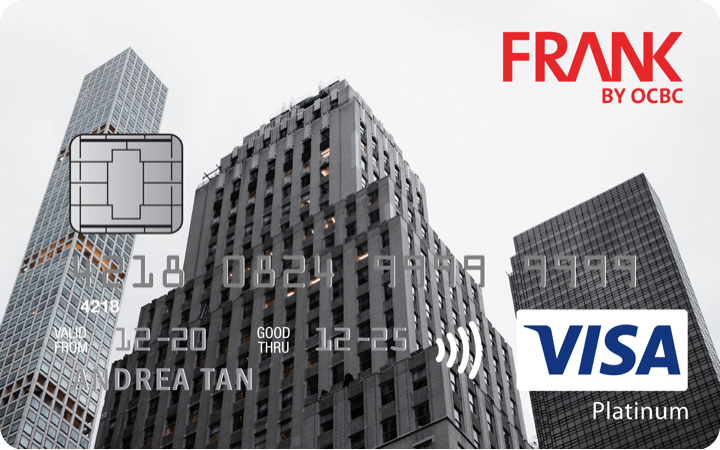

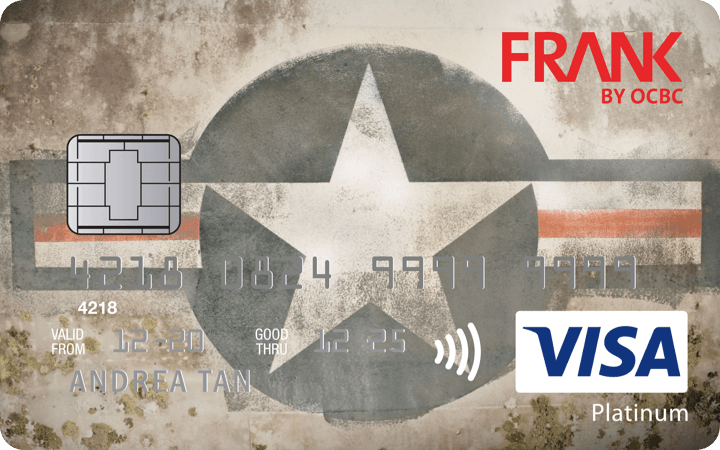

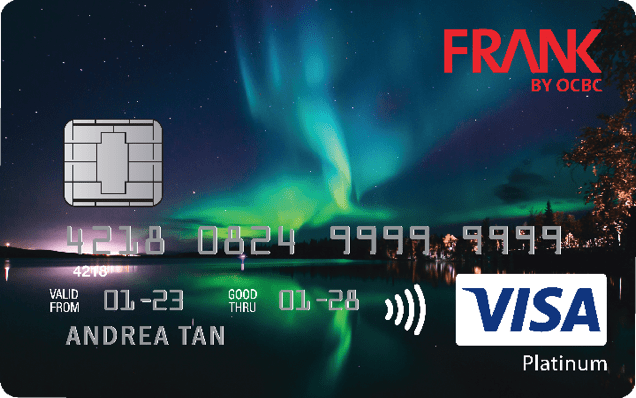

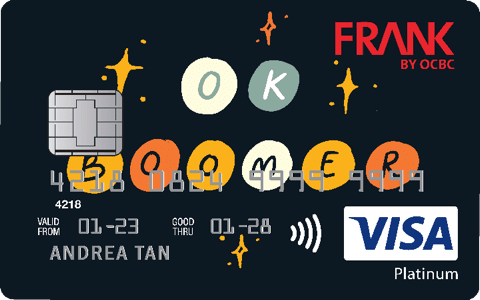

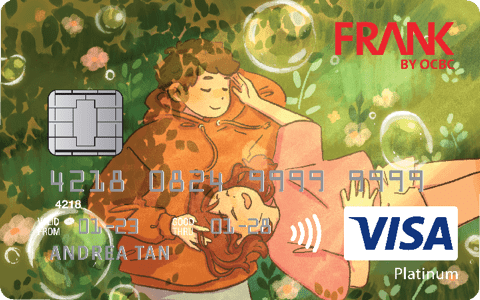

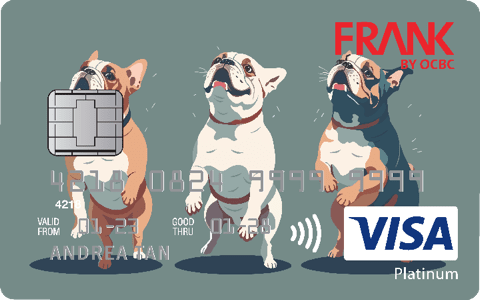

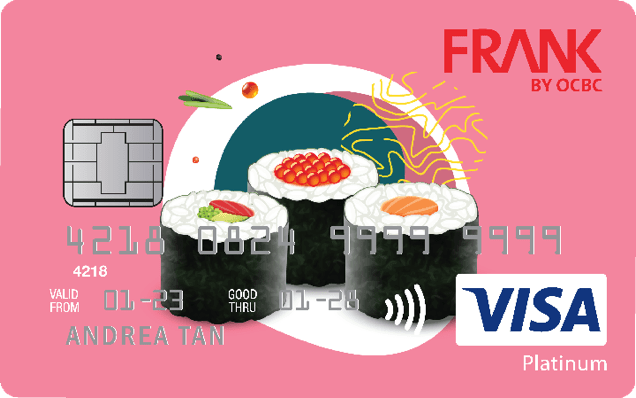

- Choose from our selected stylish card designs and earn 1% rebate when you shop, eat and ride

The 1st stop for your money

Let your FRANK Account keep your money growing while you focus on those grades.

- Up to 4x more interest than regular savings accounts

- No hidden fees

- Opened with a FRANK Debit Card - over 60 designs to choose from!

-

S$0initial deposit

Open the account with no initial deposit

-

S$0fall below fees

For youths below 26 years old

-

4xhigher interest

As compared to regular savings accounts

instant sign-up

Get your account and digital debit card instantly when you apply online via Myinfo

FRANK Account + Debit Card

Complement your account with the FRANK Debit Card

-

S$0

Annual fees

Only pay for the things you buy and nothing else

-

60+

card designs

Choose a style you vibe with in our collection

-

1%

cashback

Save when you shop at ASOS, Lazada and more

Before you apply

-

Eligibility

Min. age

16 years old

-

Letters

You will receive electronic versions of Letters for all your relationships/accounts.

Get your account running instantly

No Singpass account? Let us guide you through the application process from start to finish.

FAQ

See all FAQ-

Can I open a FRANK Account in Joint Name?

No. FRANK Accounts are not available under joint account holdings.

-

What happens when I turn 26 years old?

Once you turn 26 years old, there is a service fee of S$2 if the average daily balance for the month is less than S$1,000.

-

Why is there a hold amount & breakdown of amounts?

If you've used your debit card recently, there will a difference between your Account Balance and Available Balance – when you do a transaction on you debit card, it may take up to 7 days to reflect that transaction on the card account. After which, the transaction amount is deducted accordingly.

-

I don't have an existing SingPass can I still open a FRANK Account?

Yes, if you do not have an existing SingPass, you may apply via the following link.

Alternatively, you may apply via our online form and get your account in 5 working days.

-

I am a foreign student with a valid student pass. Can I open a FRANK Account?

Yes. Foreigner with a valid pass will be able to open a FRANK Account:

- Dependent pass

- Employment pass

- Student pass

- Long term visit pass, or

- Diplomatic pass

You are required to have your passport (with a minimum 6 months validity), a valid pass, and a proof of your residential address.

Your proof of residential address may be one of the following documents:

Latest month Telco/Utility Bill OR Latest bank statement/credit card bill statement OR Tenancy Agreement OR Income Tax Notice of Assessment OR a letter from your school indicating your valid residential address.

If you have an original Faculty/Hall of Residence Letter issued by your school, please submit all your documents at any OCBC Branches or on designated days at the FRANK Stores.

blog

-

Terms and conditions

-

Important notices

- Automatic Standing Instruction

- Online Banking

- Insured Deposits Register

- Fees & Charges

- Removal of NETS FlashPay feature on FRANK Debit Cards

- FAQ - Removal of NETS FlashPay on FRANK Cards

With effect from 18 June 2016, the Debit Cardmembers' Agreement will be revised to address, among other matters, amendments and provisions relating to the introduction of digital payment services and malware risks. Please click here for the revised Debit Cardmembers' Agreement.

-

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.