Join other trail-blazing young adults in getting monthly career & financial tips, written by those who have succeeded before.

The little dröm store collabs with FRANK by OCBC

the little dröm store is an art & design-driven retail store in Singapore. Founded by 2 graphic designers, the litte dröm store designs and produces quirky merchandise inspired by everyday Singapore.

At the little dröm store, dreams take the centre stage, symbolized by the Swedish word "dröm." This inspiring venture was born from the visionary minds of two dreamers, Stanley and Antoinette. Their shared dream is to bring creative and captivating art, along with unique knick-knacks, to the hearts of the people. Together, they embody the true spirit of the Singaporean dream, forging a path to success through passion, perseverance, and adaptability.

While taking the leap into entrepreneurship sounds sexy, their journey for them has been far from smooth. They faced numerous challenges, yet their unwavering determination and fearlessness enabled them to transition from a physical collectible store to the well-known Singapore-inspired merchandiser we see today. Recently, FRANK by OCBC had the privilege of visiting the little dröm store's humble abode to delve into their remarkable story. Their deep appreciation for Singaporean culture and refusal to let the status quo hold them back compelled them to pursue their dreams and embrace the risk.

As we stepped into their charming space, a flood of nostalgia engulfed us, reminiscent of our childhood days. The walls adorned with children’s drawings, captivating Singaporean designs, vintage cameras, and an array of art pieces created an atmosphere of creativity and imagination. Amidst this enchanting journey, we were also privileged of delving into the couple’s life odyssey, which not only encompassed their entrepreneurial endeavours, but also offered invaluable advice for the youths of today.

“Shop less at e-commerce websites and consider investing in stocks or some other form of investment. Begin saving and putting aside money every month to invest, and I can assure you that in 10 years, you'll be grateful for it. Having a future-oriented mindset is crucial.”

Celebrate Singapore's 58th birthday in true style with FRANK by OCBC and the little dröm store's collaborative masterpiece. Eight limited-edition Singapore-inspired Debit Card designs have been meticulously crafted to ignite your sense of pride in our culture and honour the real stories that have shaped our nation. These unique Debit Cards symbolize our shared identity, uniting us in our collective heritage and igniting optimism for a bright future ahead. Happy National Day 2023!

What was the history behind the little dröm store?

Before starting the little dröm store, both of us had corporate jobs in design. The idea of the little dröm store was sparked when we met a couple from church, and as we talked about our dreams and passions, we realized they loved baking while we were graphic designers. This led to us collaborating and opening our first store in 2010! The store had a shared space concept, with half of it being a café (Kki) and the other half being the little dröm store, where we sold various items like photozines, magazines, and designed goods from both overseas and local sources.

How did the little dröm store evolve from what it was before, to what it is today?

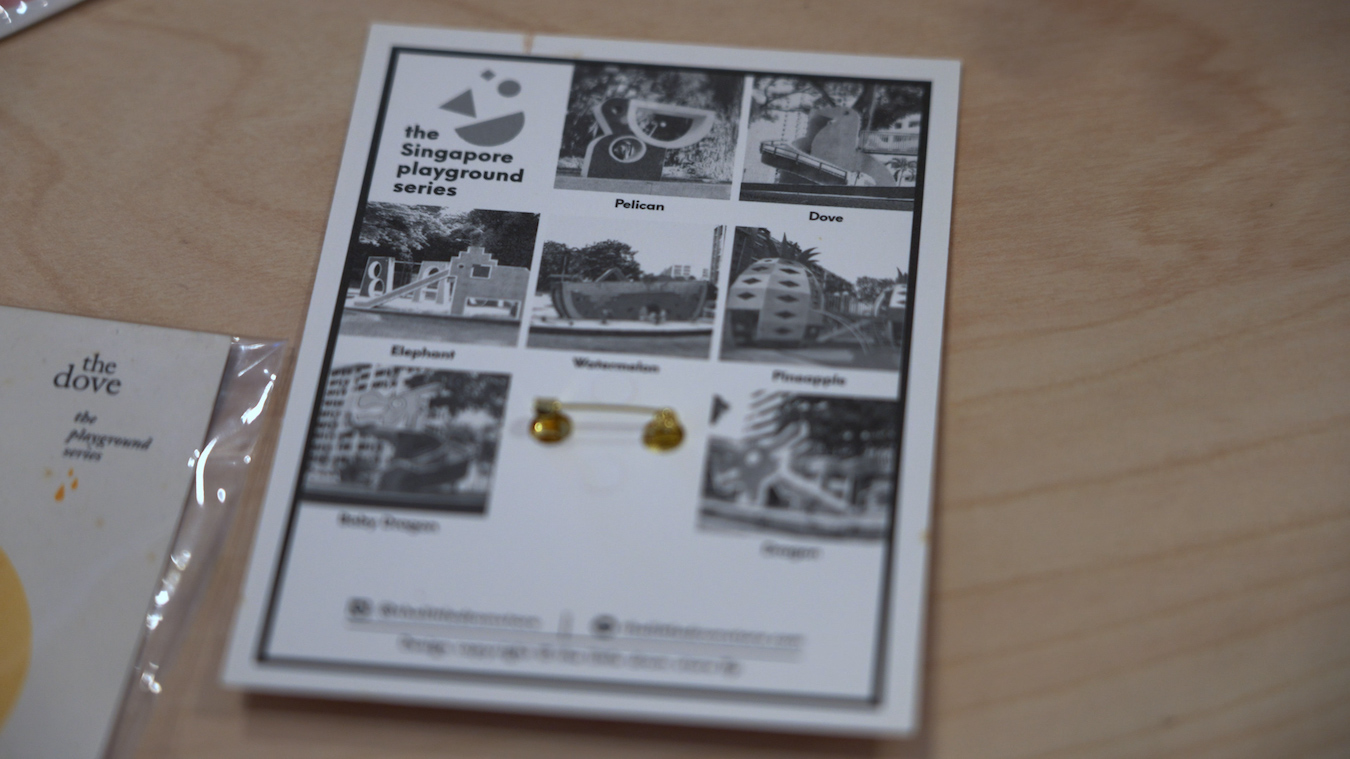

One year after establishing our store, we received an invitation to participate in the M1 Fringe Festival 2011 at the Esplanade. The festival centred around art and education, prompting us to showcase our collection of photographs featuring old-school Singapore mosaic playgrounds fashioned after categories like fruits and animals, which we had captured over the span of 10 years as a means to release pent-up frustrations from our corporate jobs previously. The dragon, pelican, dove, and elephant designs of these playgrounds embodied a unique fusion of art and education, providing a space where children played and learned simultaneously, unlike the more sheltered environments of today. In this playground, kids could get hurt, like scraping their knees, but it was okay.

Got your curiosity piqued? Get 10% off site-wide at the little dröm store with code DROMFRANK10.

This revelation inspired us to craft pins fashioned after these iconic playgrounds, particularly the dragon playground. The response from customers when we sold them at our shop was overwhelming, with exclamations like "Oh my gosh, I haven't seen this in a long time!" It became a conversation starter that brought our customers closer, as they could relate to these cherished memories. This realization motivated us to re-examine the aspects of Singapore we often took for granted and find ways to represent our rich culture in a manner that fosters meaningful connections. Thus, our journey of continuous design and creation began from there.

Subsequently, there were quite a few hits among our Singaporean publications. The Singlish vs. English books did exceptionally well. One series that became quite a hit was our "Strangely Singaporean" collection, where we represented familiar local phrases like "steady bom pii pii" and "chop chop curry pok" as Singaporean personalities. We created little badges with these phrases, associating them with positive sentiments, allowing people to take pride in them. For instance, "pattern more than badminton" was for the creative Singaporean. The series resonated with many as they could relate to the phrases they grew up with, presented in a positive light. People felt a sense of pride in wearing these badges instead of perceiving them negatively. We didn't expect this series to take off, but the response was quite encouraging. Seeing people laugh and connect with these products brought us happiness. It's heartening to know that our products can evoke emotions and be relatable to others.

We don’t see the little dröm store as an international multi-chain store, but as a platform to inspire and encourage people to live their dreams. We are happy doing what we do, and we hope that through our products, we can tell our stories, evoke memories, and bring smiles to the people.

Was it scary to transit from a corporate job to running a start-up?

Not at all, because back then, our mindset was so different. Thirteen years ago, when Delphine and Kenneth approached us to open a store together, we had sort of a naive, child-like faith mindset. We were not driven by business, financially illiterate, and introverted. Starting the store felt like a school project more than anything. We didn't worry about things like how to pay the rent every month or how to make sales; it simply didn't cross our minds. It was funny how both of us were introverted but we had to interact with customers, and by the end of the day, we would feel completely drained from talking too much. In the beginning, unlike other businesses who might have had detailed future plans and strategies, we had none of that. Our excitement revolved around things that were frivolous and on the surface level, like choosing wall colors and store decorations, such as vintage toys and cameras, to give it a treehouse vibe. Looking back, we wonder how we even survived those initial years, and it's quite amusing to reflect on.

What’s the little dröm store’s canon event?

Stanley claims that becoming a parent was the turning point, while Antoinette insists that everything started with the fringe festival in 2011, particularly the playground series. The M1 Fringe festival significantly impacted our business and our perspective on why we create the products we do. As for Stanley, parenthood completely transformed everything. We continue to manage everything ourselves, just the two of us, even to this day, striving to find the right balance. In the past few years, with a child, it has been quite challenging to juggle running the store and caring for the kids, especially since we were working from home.

What are some of the challenges you face when running the little dröm store?

Like every retailer, the main challenge we face is rental cost. Throughout the 4 years at Ann Siang Hill, the landlord increased the rental, and by the 4th year, the rental was doubled, which led us and Kki to decide to close and search for a new space. It took us 1.5-2 years to find a new location at SOTA. Dealing with rental costs is particularly difficult because we invest significant money in renovation and fixtures, making it challenging to uproot and relocate. We definitely think rental is a killer.

Another obstacle is understanding the ever-changing business landscape and identifying what customers want to buy. As a retail store, our success depends on catering to customer preferences, which means finding the balance between our own interests and customer demands. Over the years, we've had conversations about why the things we personally like often don't align with customers' preferences. During these discussions, there would be times where Antoinette was excited about a product, and Stanley would laugh and exclaim, “You want to do this? Don’t lah, you like one, customers sure won’t like one”. I think we've learned through trial and error, sometimes mistakenly thinking a series will be a hit, only to face disappointing sales upon its launch *cues plane descending sounds*. We continue to learn and adapt, striving to anticipate popular products, but we still experience both hits and misses along the way.

In the beginning, there were some struggles in managing our dynamics. We have our differences and disagreements, but at the ultimately, we are on the same team and we want to make things work. To overcome these challenges, we try to set aside personal feelings. Our roles also naturally evolved, resulting in fewer overlaps. Stanley handles the designing while Antoinette handles the logistics. The division of responsibilities organically occurred, reducing clashes. Although we don't have many departments, we have our distinct roles. As for our marriage, we've become more mature over time. In our younger days, there was more clashing and butting heads, but as we've grown in our relationship, we've learned to know what to expect, give and take, and compromise. Marriage and business, for us, have become somewhat similar in this regard.

What advice would you have for your younger self?

Definitely, we would have liked to be more financially savvy. Starting investing early and educating ourselves more about business and personal finances would have been beneficial. Looking back, as designers, we were often drawn to aesthetics, sometimes overlooking practicality. In hindsight, we wish we had made more balanced decisions that considered both financial and aesthetic aspects, rather than letting aesthetics overshadow everything. Additionally, we regret buying unnecessary items impulsively just because they looked good. We were visual junkies, constantly accumulating things we didn't really need. An amusing incident occurred when elderly folks visited our shop in Chinatown. They would ask questions like, “What is this?”, “What are you selling?”, and “Can survive?”. It really hits different when they asked those questions and we would respond, “We are trying”.

What inspired you to create these designs?

It’s the little things we take for granted in Singapore that inspired us. For instance, while we look at these beige buildings and blocks daily, we overlook the effectiveness and magnificence of our HDB housing system, unlike many countries where people have had to struggle for housing and a place to live. Even down to language and food, the words we use and the meals we consume daily may seem ordinary, but they each carry stories and histories that shape our culture.

It’s the beauty found in the mundane aspects of Singaporean life that adds depth to our identity. While some might consider Singapore as a bland melting pot of diverse nationalities, races, and cultures, there's actually so much to discover when we delve into it. I remember when we were designing Singapore souvenirs, we leaned towards vintage and old-school designs, reflecting the perspectives of the 80s and early 90s, the things we grew up with. However, a conversation with a friend changed my view. He pointed out that now, people think of modern icons like Marina Bay Sands and Gardens by the Bay when they envision Singapore. It made me realize that we should incorporate both the new and the old, reflecting the ever-changing nature of Singapore. In the future perhaps, even Marina Bay Sands and Gardens by the Bay might not be the main icons of Singapore anymore, as it will continue to evolve.

We also want the people to take a moment to cherish the little things we have now, such as the food we enjoy. We often hear about old-school kueh stores and mama stores closing down, becoming rarer and rarer. These occurrences serve as reminders of what we had in the past and help us appreciate the present. Take a look around you; there are countless beautiful things waiting to be explored and discovered in Singapore.

Which of these designs is your favourite?

Stanley's favorite is Singapore Nightlife because it represents our progressiveness, constantly changing yet embracing the coexistence of the old and the new.

Antoinette's favorite is the hawker stall, as she finds immense beauty in it. It's not just the aroma of the food that captivates her, but also the vibrant colors present. We once had a friend from Australia visit, and she was mesmerized by the matching cutleries in various colors and the little stickers on the kopitiam cups that represented different stores. These are the little things we often overlook, but when viewed from a different perspective, they become truly refreshing and eye-opening. Even something as simple as the bandung drink left her fascinated by its pink hue. It's moments like these that make Antoinette proud of our hawker culture and all that it embodies.

FRANK by OCBC: Limited edition FRANK by OCBC Debit Card designed by the little dröm store are available until 31 August 2023, find out more here!

Compared to when you were a student, how differently did you manage your finances?

As we progress in life, priorities and perspectives inevitably change. What was once important may not hold the same significance now, and what matters now may not carry the same weight five years down the road. As adults, with more commitments and loans, we find ourselves thinking more critically before making any expenditures. Growing older prompts us to consider financial freedom, unlike our carefree days as students when consequences and future challenges weren't a top concern. Running our business made us more aware of the need for long-term planning. In our youth, we tended to focus on short-term pleasures, living in the moment. However, as we mature, we prioritize future planning. Despite progressing slower than our peers due to our initial lack of financial knowledge, we have been learning along the way, gradually becoming more financially savvy. We definitely wished we started investing earlier.

Having kids has also compelled us to deeply consider planning for the future—both theirs and ours. As we age, we naturally start contemplating various aspects of life, such as caring for our parents, retirement, and achieving financial freedom. We also ponder the longevity of the little dröm store and how long we intend to run it. These profound thoughts accompany the aging process, and we find ourselves pondering how we will afford our children's education in the future, particularly if they desire to study overseas.

When did you start investing?

We started investing in stocks about 2 years ago, and looking back, I feel like I should have started when I was a student. We try to invest regularly, even though there isn't a fixed amount, due to the variable income from running our business. In months with good sales, we invest more, and in slower months, we invest less. It may seem random, but the key is to maintain the momentum of investing.

We opted for stocks because an opportunity presented itself and seemed more straightforward. Both of us had no prior knowledge about investments, but Antoinette's brother, who was into stocks, convinced us to give it a try. We simply took advantage of opportunities that made sense to us at the time and jumped onboard. Before that, we had no investments, so we definitely wish we had started earlier.

FRANK by OCBC: New to investing? Look no further! OCBC’s Blue Chip Investment Plan offers you the chance to start investing in Singapore-listed blue chips and ETFs regularly for as little as S$100 a month.

What has been your best investment and worst investments?

I believe taking the leap of faith to purchase a house was one of the best investments because, in Singapore, property values always seem to be on the rise. Five years ago, acquiring the house was a significant and costly step, with a substantial loan. However, looking back now, we are grateful for its increased value over time, making it a wise decision. Moreover, it's an asset we can pass down to our children, as it's a freehold property, adding to its investment value. Apart from that, another great investment was choosing not to open a physical store but instead investing our time in our children. As hands-on parents without a helper, we made a deliberate choice to dedicate time to our kids. We see this as an investment in their long-term well-being, building strong relationships with them and investing in their future.

Our worst investments were buying many things we didn't actually need, such as designer toys, collectibles, and vintage goods. Looking back, we realize it was impulsive, and we now feel that we didn't require so much stuff. Additionally, we made some poor business decisions regarding certain products. While we had both hits and misses, some of the misses were significant, like investing a lot of money in creating items that didn't perform well or sell. However, we have learned from these experiences and have since optimized our business decisions, understanding what is popular and what isn't.

What would be your financial tip for the youths today?

Shop less on Taobao and consider investing in stocks or some other form of investment. Begin saving and putting aside money every month to invest, and I can assure you that in 10 years, you'll be grateful for it. Having a future-oriented mindset is crucial. As youths, it's effortless to focus on the present and get caught up in the moment. However, take some time to ponder your purpose and future plans NOW. Time is on your side when you're young, and time is money. We've seen friends who started investing 20 years earlier than us and are now financially free because they began much earlier. Starting to save and invest early is far easier than trying to catch up later in your late 30s or 40s.

We’re truly excited to collaborate with FRANK by OCBC, as it empowers young people with the right financial education – something we wished we had earlier.

Disclaimer

This is for general information and does not take into account your particular investment and protection aims, financial situation or needs. You may wish to seek advice from a financial adviser before making a commitment to purchase an investment product. In the event that you choose not to seek advice from a financial adviser, you should consider whether the investment in question is suitable for you.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

IMPORTANT NOTICES

- Any opinions or views of third parties expressed in this document are those of the third parties identified, and do not represent views of Oversea-Chinese Banking Corporation Limited (“OCBC Bank”, “us”, “we” or “our”).

- This information is intended for general circulation and / or discussion purposes only. It does not consider the specific investment objectives, financial situation or needs of any particular person.

- Before you make an investment, please seek advice from your Relationship Manager regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs.

- If you choose not to do so, you should consider if the investment product is suitable for you, and conduct your own assessments and due diligence on the investment product.

- We are not making an offer, solicit to buy or sell or subscribe for any security or financial instrument, enter into any transaction or participate in any trading or investment strategy with you through this document. Nothing in this document shall be deemed as an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into any transaction or to participate in any particular trading or investment strategy.

- No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice.

- OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

- Investments are subject to investment risks, including the possible loss of the principal amount invested. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

- The information in and contents of this document may not be reproduced or disseminated in whole or in part without the Bank’s written consent.

- OCBC Bank, its related companies, and their respective directors and/or employees (collectively “Related Persons”) may, or might have in the future, interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

- You must read the Offer Document/Indicative Term Sheet/Product Highlight Sheet before deciding whether or not to purchase the investment product, copies of which may be obtained from your relationship manager.

- Any hyperlink to any third party article, or other website or webpage (including any websites or webpages owned, operated and maintained by third parties) is for informational purposes only and for your convenience only and is not an endorsement or verification of any such article, website or webpage by OCBC Bank and should only be accessed at your own risk. OCBC Bank does not review the contents of any such articles, website or webpage, and shall not be liable to any person for the same.

Collective Investment Schemes

- A copy of the prospectus of each fund is available and may be obtained from the fund manager or any of its approved distributors. Potential investors should read the prospectus for details on the relevant fund before deciding whether to subscribe for, or purchase units in the fund.

- The value of the units in the funds and the income accruing to the units, if any, may fall or rise. Please refer to the prospectus of the relevant fund for the name of the fund manager and the investment objectives of the fund.

- Investment involves risks. Past performance figures do not reflect future performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

- The indicative distribution rate may not be achieved and is not an indication, forecast, or projection of the future performance of the Fund. For funds that are listed on an approved exchange, investors cannot redeem their units of those funds with the manager, or may only redeem units with the manager under certain specified conditions. The listing of the units of those funds on any approved exchange does not guarantee a liquid market for the units.

Global Equities disclaimer

- Dividend growth is not guaranteed, nor are companies in which you invest obliged to pay dividends;

- Companies may go bankrupt rendering the original investment valueless;

- Equity markets may decline in value;

- Corporate earnings and financial markets may be volatile;

- If there is no recognised market for equities, then these may be difficult to sell and accurate information about their value may be hard to obtain;

- Smaller company investments may be difficult to sell if there is little liquidity in the market for such equities and there may be substantial differences between the buying price and the selling price;

- Equities on overseas markets may involve different risks to equities issued in Singapore;

- With regards to investments in overseas companies, foreign exchange rates may move in an unfavourable direction affecting adversely the valuation of investments in base currency terms.